Some Known Incorrect Statements About Frost Pllc

Table of ContentsThe 3-Minute Rule for Frost PllcThe Main Principles Of Frost Pllc Not known Details About Frost Pllc What Does Frost Pllc Do?Frost Pllc Can Be Fun For Everyone

Certified public accountants are among the most trusted careers, and permanently factor. Not just do CPAs bring an unrivaled degree of expertise, experience and education and learning to the process of tax planning and handling your cash, they are specifically educated to be independent and objective in their work. A certified public accountant will help you shield your rate of interests, listen to and resolve your issues and, just as crucial, provide you satisfaction.In these critical minutes, a CPA can supply greater than a basic accounting professional. They're your relied on advisor, guaranteeing your organization remains economically healthy and legitimately safeguarded. Working with a regional certified public accountant company can positively affect your business's financial health and wellness and success. Right here are five key benefits. A neighborhood certified public accountant company can help in reducing your company's tax obligation problem while making sure compliance with all suitable tax regulations.

This growth shows our commitment to making a favorable effect in the lives of our customers. Our dedication to excellence has actually been acknowledged with multiple distinctions, including being named among the 3 Best Bookkeeping Companies in Salt Lake City, UT, and Best in Northern Utah 2024. When you deal with CMP, you end up being component of our household.

10 Easy Facts About Frost Pllc Explained

Jenifer Ogzewalla I have actually functioned with CMP for numerous years currently, and I have actually truly valued their competence and effectiveness. When auditing, they work around my schedule, and do all they can to maintain continuity of personnel on our audit.

Below are some essential inquiries to assist your decision: Check if the certified public accountant holds an active certificate. This assures that they have passed the needed tests and meet high honest and professional requirements, and it reveals that they have the qualifications to manage your financial matters responsibly. Verify if the certified public accountant supplies solutions that line up with your business needs.

Small businesses have special economic requirements, and a CPA with pertinent experience can give even more tailored guidance. Ask regarding their experience in your industry or with businesses of your size to ensure they understand your specific difficulties.

Clear up how and when you can reach them, and if they provide regular updates or assessments. An available and responsive CPA will be indispensable for prompt decision-making and assistance. Hiring a local CPA firm is even more than just contracting out economic tasksit's a wise investment in your service's future. At CMP, with workplaces in Salt Lake City, Logan, and St.

The smart Trick of Frost Pllc That Nobody is Discussing

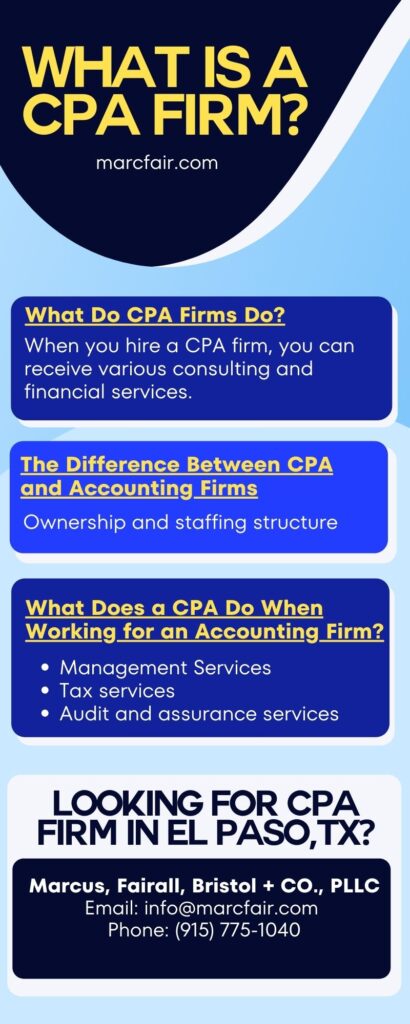

An accounting professional that has passed the certified public accountant examination can represent you prior to the IRS. Certified public accountants are certified, accounting experts. Certified public accountants may work for themselves or as component of a firm, depending upon the setup. The cost of tax obligation preparation might be reduced for independent professionals, but their expertise and capability may be less.

The 9-Second Trick For Frost Pllc

Taking on this obligation can be a frustrating job, and doing something incorrect can cost you both economically and reputationally (Frost PLLC). Full-service certified public accountant companies are acquainted with declaring demands to guarantee your service adhere to federal and state laws, along with those of financial institutions, financiers, and others. You might require to report extra earnings, which might require you to file a tax obligation return for the very first time

Certified public accountants are the" huge weapons "of the accounting sector and normally don't take care of daily accountancy tasks. You can make certain all your financial resources are present which you remain in excellent standing with the internal revenue service. Hiring an audit company is an evident choice for complicated businesses that can manage a licensed tax professional and an excellent alternative for any tiny company that intends to minimize the opportunities of being audited and offload the problem and headaches of tax declaring. Open rowThe distinction in between a certified public accountant and an accounting professional is simply a legal difference - Frost PLLC. A certified public accountant is an accounting professional licensed in their state of procedure. Only a CPA can supply attestation services, serve as a fiduciary to you and function as a tax attorney if you deal with an internal revenue service audit. No matter your situation, even the busiest accounting professionals can relieve the moment burden of filing your tax obligations on your own. Jennifer Dublino contributed to this short article. Resource meetings were performed for a previous version of this post. Bookkeeping business might additionally use Certified public accountants, but they have other types of accounting professionals on personnel. Frequently, these various other sorts of accounting professionals have specializeds throughout locations where having a CPA certificate isn't called for, such as management audit, not-for-profit audit, price bookkeeping, government accounting, or audit. That does not make them less certified, it just makes them in a different way certified. In exchange for these more stringent guidelines, Certified public accountants have the lawful authority to authorize audited monetary statements for the functions of coming close to capitalists and protecting funding. While audit companies are not bound by these exact same policies, they need to still stick to GAAP(Usually Accepted Bookkeeping Concepts )best techniques and exhibit high

honest criteria. For this factor, cost-conscious little and mid-sized business will often make use of an accounting services firm to not just fulfill their bookkeeping and accountancy demands currently, yet to range with them as they expand. Do not allow the regarded eminence of a company filled with Certified public accountants sidetrack you. There is a false impression that a CPA firm will certainly do a much better job because they are legitimately permitted to

take on even more tasks than an accounting firm. And when this holds true, it doesn't make any kind of feeling to pay the premium that a CPA company will bill. In many cases, organizations can minimize prices dramatically while still having high-quality work done by using an accounting solutions company rather. Therefore, utilizing an accountancy solutions company is commonly a far better worth than employing a anchor CERTIFIED PUBLIC ACCOUNTANT

Indicators on Frost Pllc You Should Know

firm to support your continuous economic administration efforts. If you only need interim audit help while you function on employing a permanent accounting professional, we can assist with that as well! Our bookkeeping and finance recruiters can assist you bring in the ideal candidate for an internal role. Contact us to find out more today!. They can interact to make sure that all elements of your financial plan are aligned which your investments and tax obligation methods interact. This can bring about much better outcomes and a lot more reliable use your resources.: Dealing with a consolidated certified public accountant and financial advisor can save prices. By having both specialists collaborating, you can stay clear of replication of solutions and possibly decrease your total costs.

Brickley Wide Range Management is a Registered Investment Advisor *. Advisory services are just provided to customers or possible customers where Brickley Riches Management and its agents are properly licensed or exempt from navigate to these guys licensure. The details throughout this web site is only for informative functions. The web content is created from sources believed to give precise information, and we conduct affordable due persistance evaluation

however, the info included throughout this site goes through change without notification and is not without error. Please consult your investment, tax, or lawful consultant for aid concerning your specific situation. Brickley Riches Management does not offer lawful guidance, and nothing in this web site will be construed as lawful guidance. For more information on our company and our advisors, please see the latest Kind ADV and Component 2 Brochures and our Client Partnership Recap. The not-for-profit board, or board of supervisors, is the legal controling body of a not-for-profit company. The participants of a not-for-profit board are in charge of understanding and imposing the legal demands of a company. They also concentrate on the high-level technique, oversight, and responsibility of the organization. While there are many candidates deserving of signing up with a board, a CPA-certified accounting professional brings a special skillset with them and can work as an important resource for your not-for-profit. This firsthand experience grants them insight into the behaviors and practices of a solid managerial team that they can after that share with the board. Certified public accountants also have expertise in creating and refining organizational plans and procedures and assessment of the practical requirements of staffing models. This offers them the one-of-a-kind skillset to evaluate management groups and use referrals. Trick to this is the capability to understand and translate the nonprofits'annual financial declarations, which give insights into how a company generates profits, just how much it sets you back the organization to operate, and how efficiently it manages its donations. Often the economic lead or treasurer is entrusted with managing the budgeting, projecting, and review and oversight of the financial info and financial systems. One of the advantages of being an accounting professional is functioning closely with participants of various companies, including C-suite executives and other choice makers. A well-connected CPA can take advantage of their network to aid the organization in various strategic and getting in touch with roles, effectively attaching the company to the optimal prospect to fulfill their needs. Next time you're aiming to fill up a board seat, take into consideration connecting to a certified public accountant that can bring value to your company in all the ways he said provided above. Desire to find out more? Send me a message. Clark Nuber PS, 2022.